Weekly market wrap

Midyear Review: A look back, and our outlook for what's ahead

Key Takeaways:

- Cooling but positive economic growth and moderating inflation have provided a favourable backdrop for stocks to continue delivering strong performance, with the TSX, S&P 500 and Nasdaq all notching record highs this week.

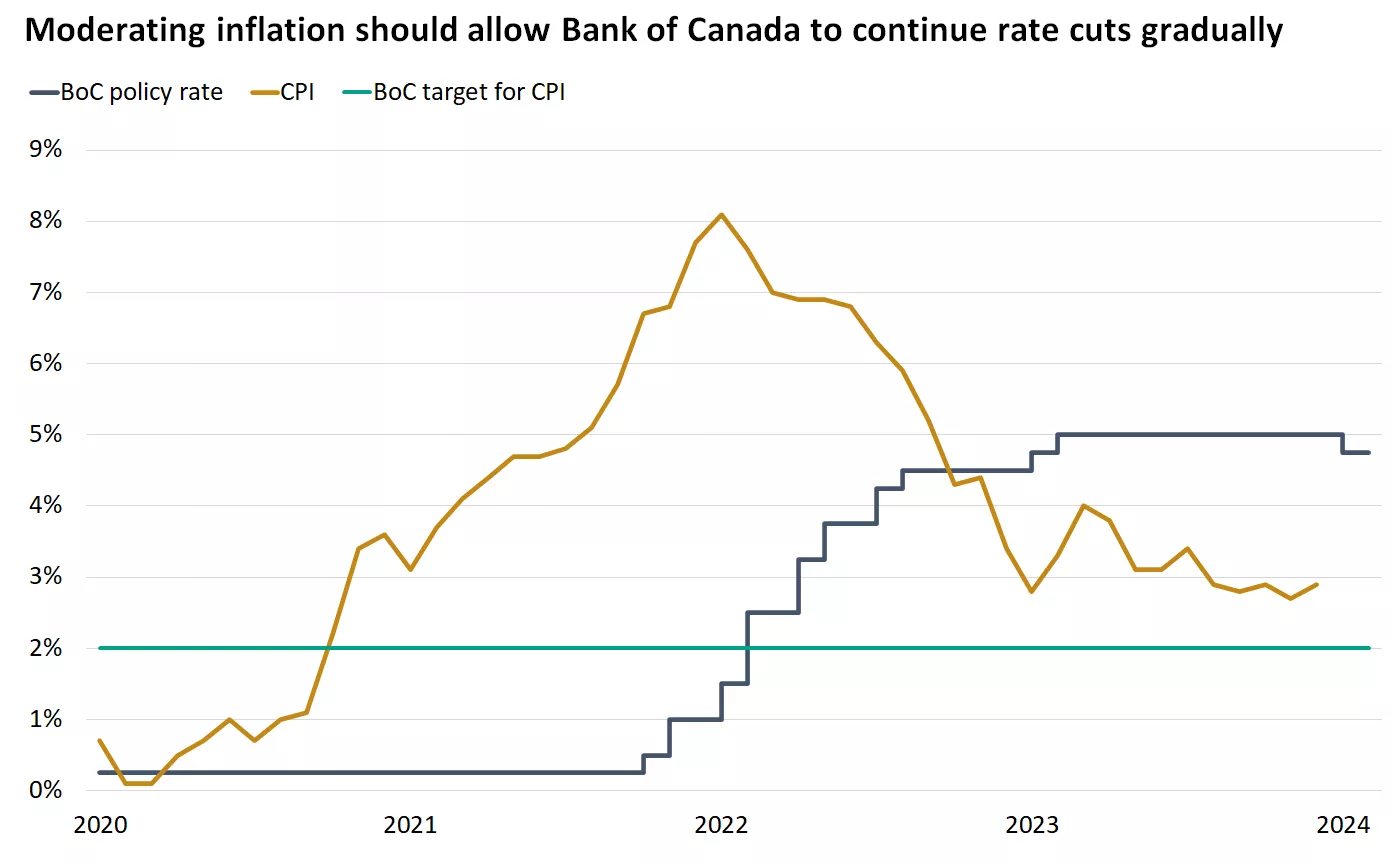

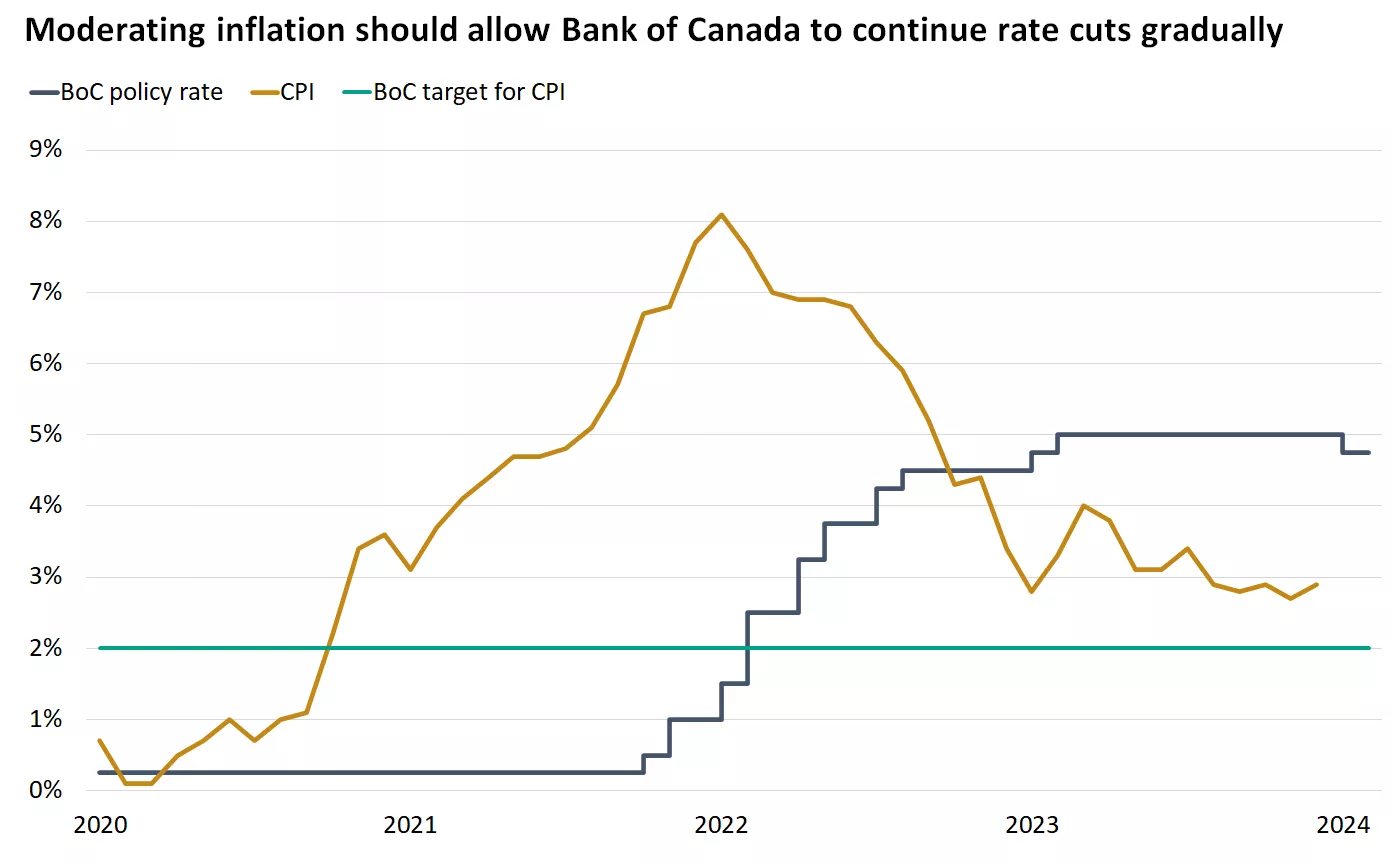

- Despite ticking up to 2.9% annualized in May, Canadian consumer price index (CPI) inflation has moved steadily lower from the recent peak of 8.1% in June 20221. U.S. CPI has also moderated, coming in at 3.0% year-over-year in June, the lowest reading since March 20212. Moderating inflation should keep the Bank of Canada (BoC) on track to continue cutting rates later this year and the Federal Reserve (Fed) to follow with its first interest-rate cuts by year-end.

- The Canadian labour market shows continued signs of cooling, with the unemployment rate at 6.4%, up from the recent low of 4.8% in July 2022. A further pickup in unemployment could put downward pressure on wage growth and inflation.

Looking back at the first half of the year

Equity markets rose in the first half of 2024, led by a 19.6% gain in U.S. large-cap stocks. Enthusiasm around artificial intelligence (AI), along with robust profit growth, has lifted the information technology and communication services sectors of the S&P 500. Canadian large-cap and mid-cap stocks saw healthy gains as well, with large-cap rising by 6.1% and mid-cap by 11%.

Interest rates increased in the first half of the year, pressuring investment-grade bonds. Steady global economic growth supported lower-quality issuers, driving global high-yield bonds to modest gains. Following rate hikes to combat inflation, the European Central Bank (ECB) and BoC were the first of the G7 central banks to lower policy rates. After several months of higher-than-expected inflation to begin 2024, U.S. inflation resumed its trend lower in the second quarter.

Overseas stocks gained in the first half of 2024, with emerging-market stocks leading developed overseas large-cap stocks. Fiscal support from China helped emerging-market stocks, while improving economic growth in Europe and strong corporate profit growth in Japan aided overseas large-cap stocks in the first half.

Economic outlook

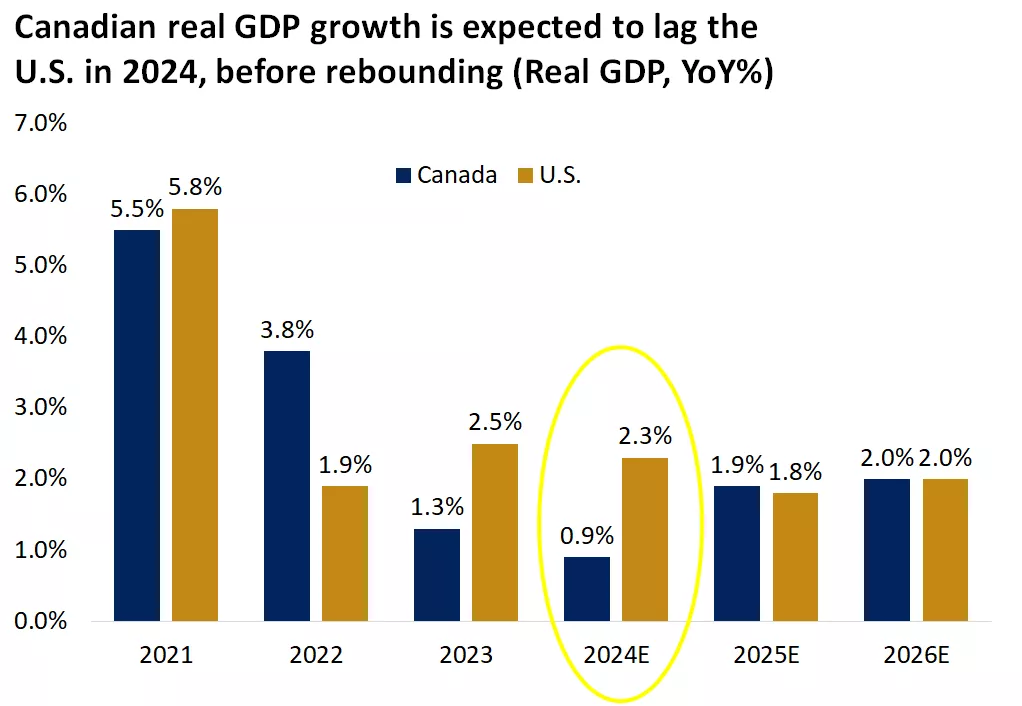

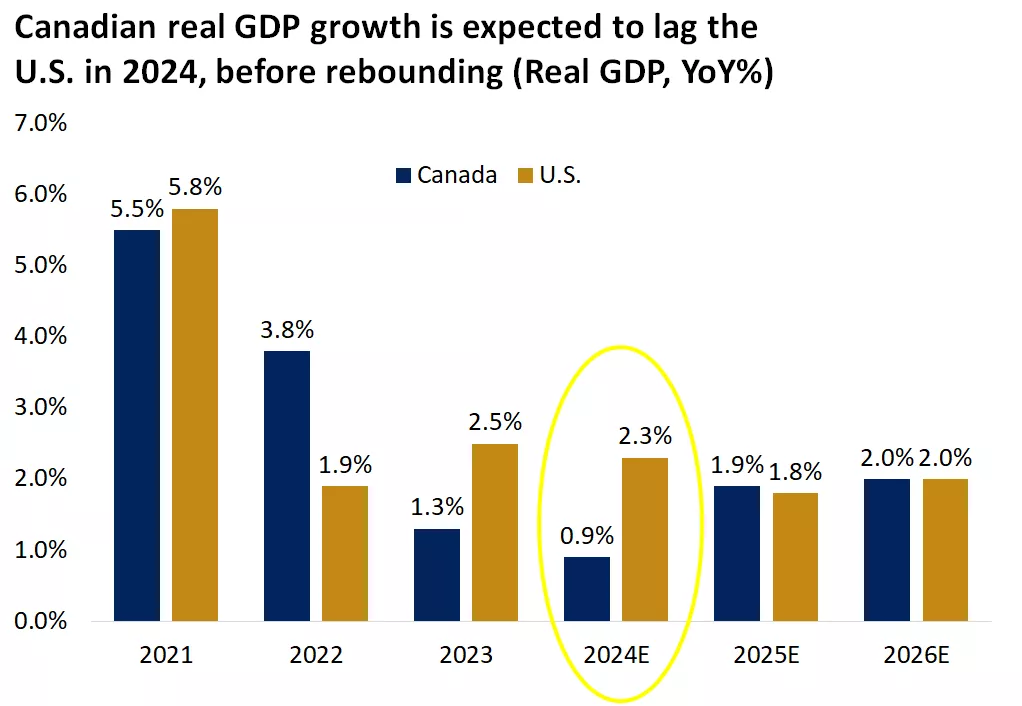

This chart shows real GDP growth and real GDP growth estimates in Canada and the U.S. from 2021 - 2026.

This chart shows real GDP growth and real GDP growth estimates in Canada and the U.S. from 2021 - 2026.

The Canadian economy has emerged from a soft patch in the back half of 2023 but remains near trend readings. In the first quarter, real GDP growth was 1.7% annualized, supported by solid household consumption. However, this may slow throughout the year, as consumption is expected to moderate.

Following a period of strength, the Canadian labour market has cooled, with the unemployment rate rising to 6.4%, the highest since January 2022. Leading indicators point to further softening, as job vacancies (job openings in the economy) have fallen to recent lows. Meanwhile, labour supply continues to increase, supported by immigration. A further pickup in unemployment could put some downward pressure on wage growth.

Canadian CPI inflation rates have moved steadily lower, despite surprising to the upside for the month of May. The CPI inflation rate in Canada stands at 2.9%, versus 3.0% in the U.S., and we believe these inflation rates could head lower due to two potential drivers: 1. Shelter and rent components of inflation moderate, especially given that real-time data for Canadian home price appreciation has already slowed; and 2. Services inflation cools as wage growth potentially slows.

Equity outlook

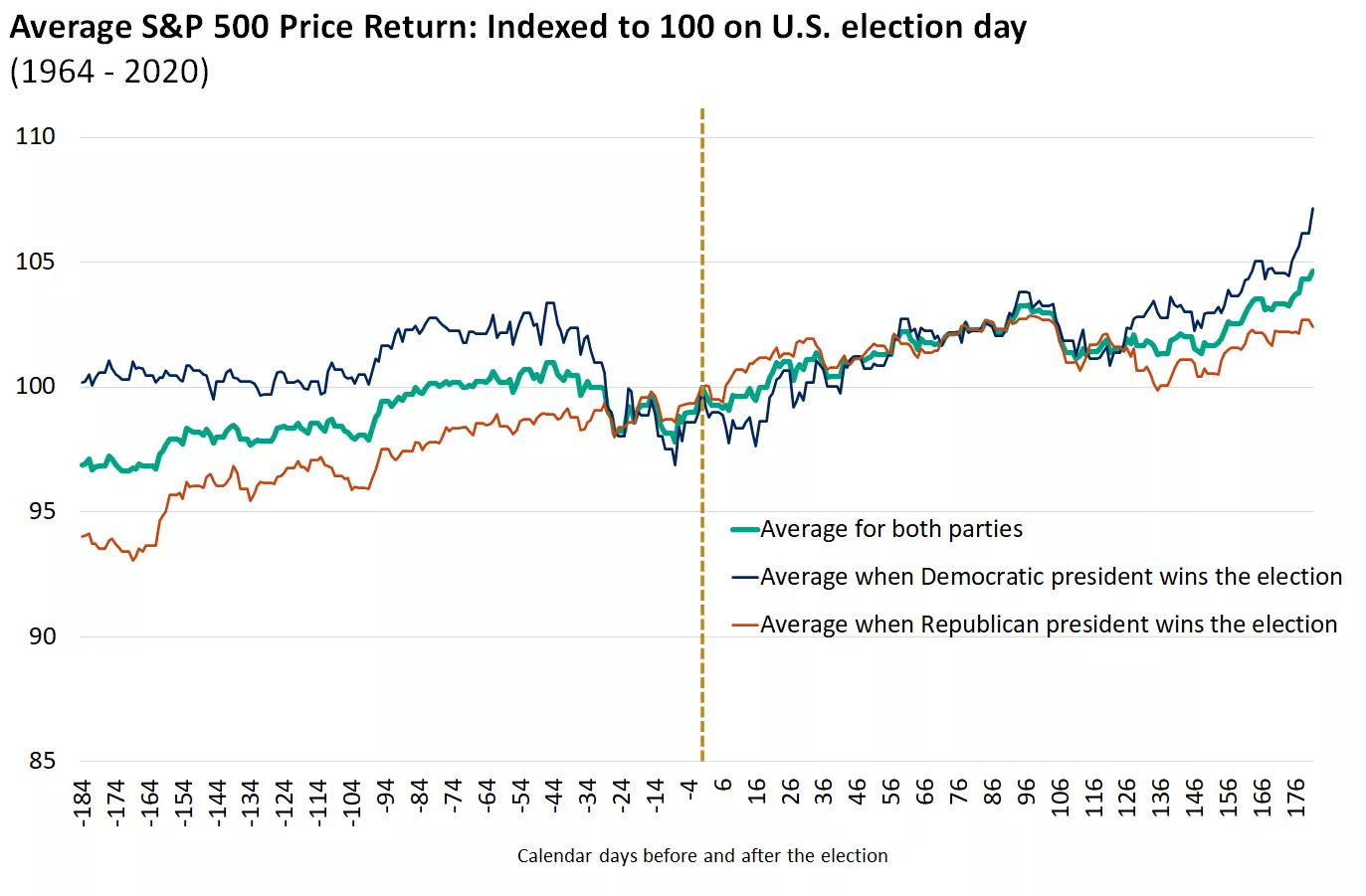

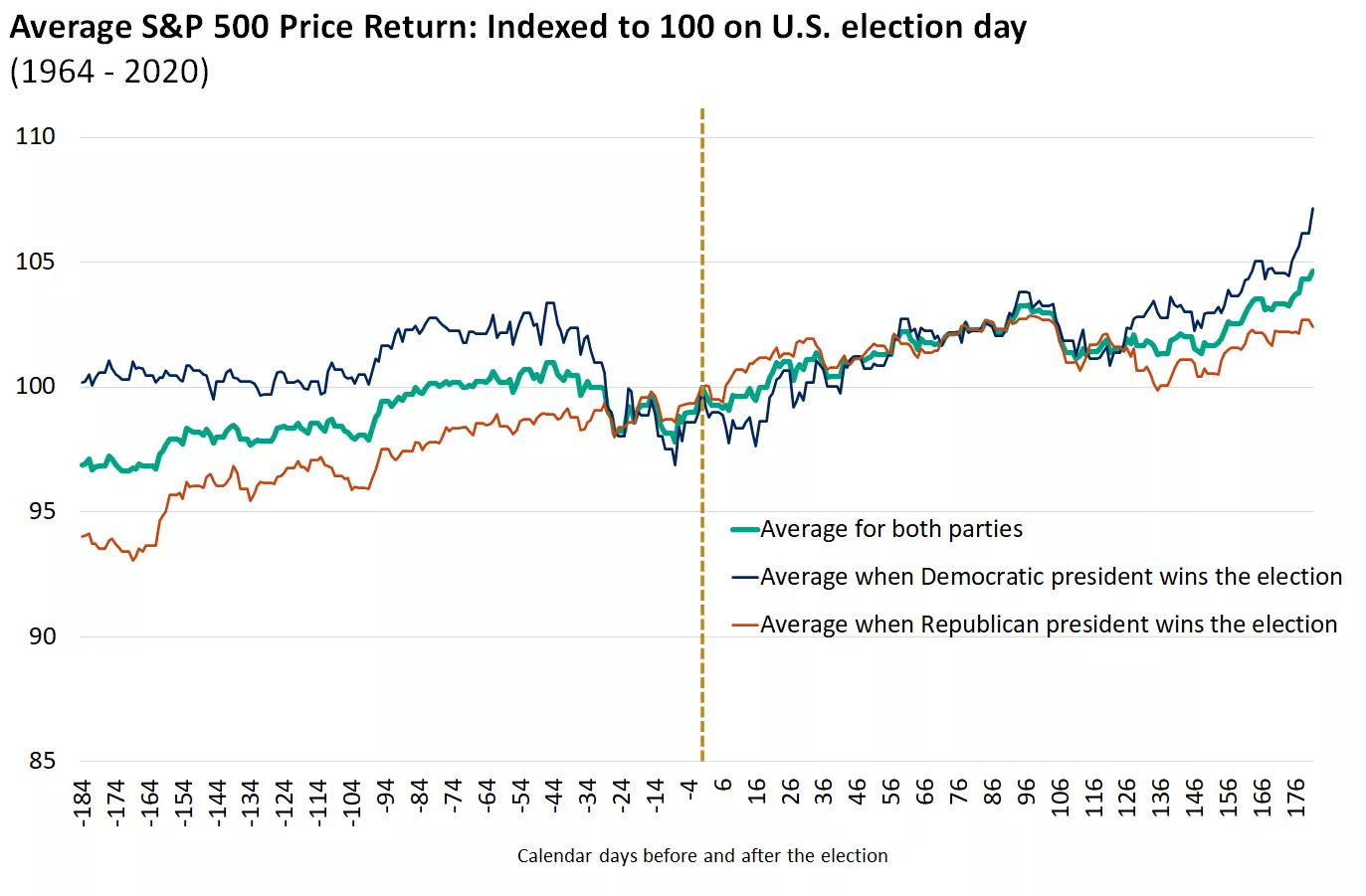

This chart shows the average performance of the S&P 500 in the 6-months before and after U.S. election days going back to 1964. Past performance does not guarantee future results.

This chart shows the average performance of the S&P 500 in the 6-months before and after U.S. election days going back to 1964. Past performance does not guarantee future results.

We believe technology-focused sectors will continue to play a meaningful role in portfolios. The technology, communication services and consumer discretionary sectors, all of which include mega-cap AI stocks, represent more than half of the S&P 500. These companies have delivered on earnings and also have fortress cash positions, allowing them to reinvest in their businesses and return value to shareholders.

But we continue to believe that market leadership should broaden beyond mega-cap technology. First, while recent earnings growth has come largely from technology-related companies, by the fourth quarter earnings growth will likely be driven equally by other sectors. Second, as we get closer to Fed rate cuts, and the BoC continues its rate-cutting cycle, cyclical areas of the market may play catch-up as lower yields support the economy. And finally, over time, productivity gains and efficiencies from AI will be felt across sectors, in our view.

In this election cycle, we expect the U.S. Congress to remain divided, which means no major new regulation or legislation is likely, regardless of which party wins. Markets typically prefer political gridlock, as it means a more transparent operating environment for companies. Over the long run, markets tend to follow the fundamentals — including inflation, interest rates and economic growth — more so than politics and elections.

Fixed-income outlook

This chart shows the year-over-year change in Canadian CPI relative to the Bank of Canada's policy rate and its target for inflation.

This chart shows the year-over-year change in Canadian CPI relative to the Bank of Canada's policy rate and its target for inflation.

BoC cut its policy rate to 4.75% from 5.0% in June, citing evidence that inflation is easing on a more sustained path toward its 2% target. While CPI ticked up to 2.9% in May, we expect inflation to continue to moderate, allowing for additional rate cuts toward the end of this year. As the timing of additional BoC easing becomes clearer, short-term yields should decline, likely steepening the yield curve and leading to higher reinvestment risk for short-term bonds and GICs. We see value in intermediate- and long-term bonds, which allow investors to lock in higher rates for longer. Maturing or called bonds and GICs could be a source of funds to extend duration or to reallocate to underrepresented asset classes.

At its June meeting, the Fed trimmed expectations to one interest-rate cut for this year. We expect moderating inflation to allow the Fed to pivot to rate cuts potentially in September and/or December. A likely Fed pivot to interest-rate cuts should support the U.S. economy, which would be favourable for stocks. Bonds typically perform well during Fed rate-cutting cycles, as their prices rise, but they could underperform U.S. small- and mid-cap stocks, which offer a balance of quality and cyclicality to potentially benefit from the ongoing U.S. economic expansion.

International outlook

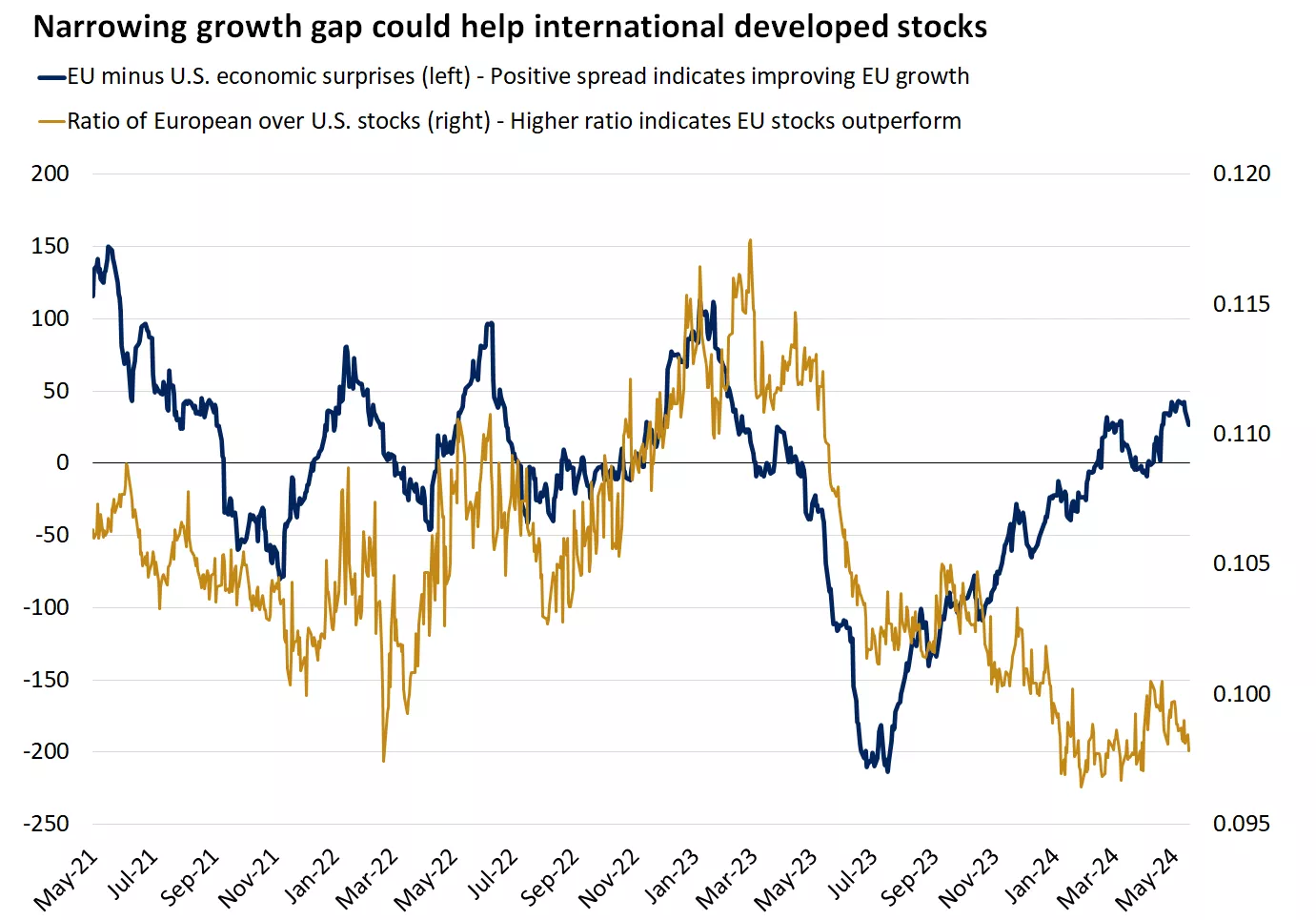

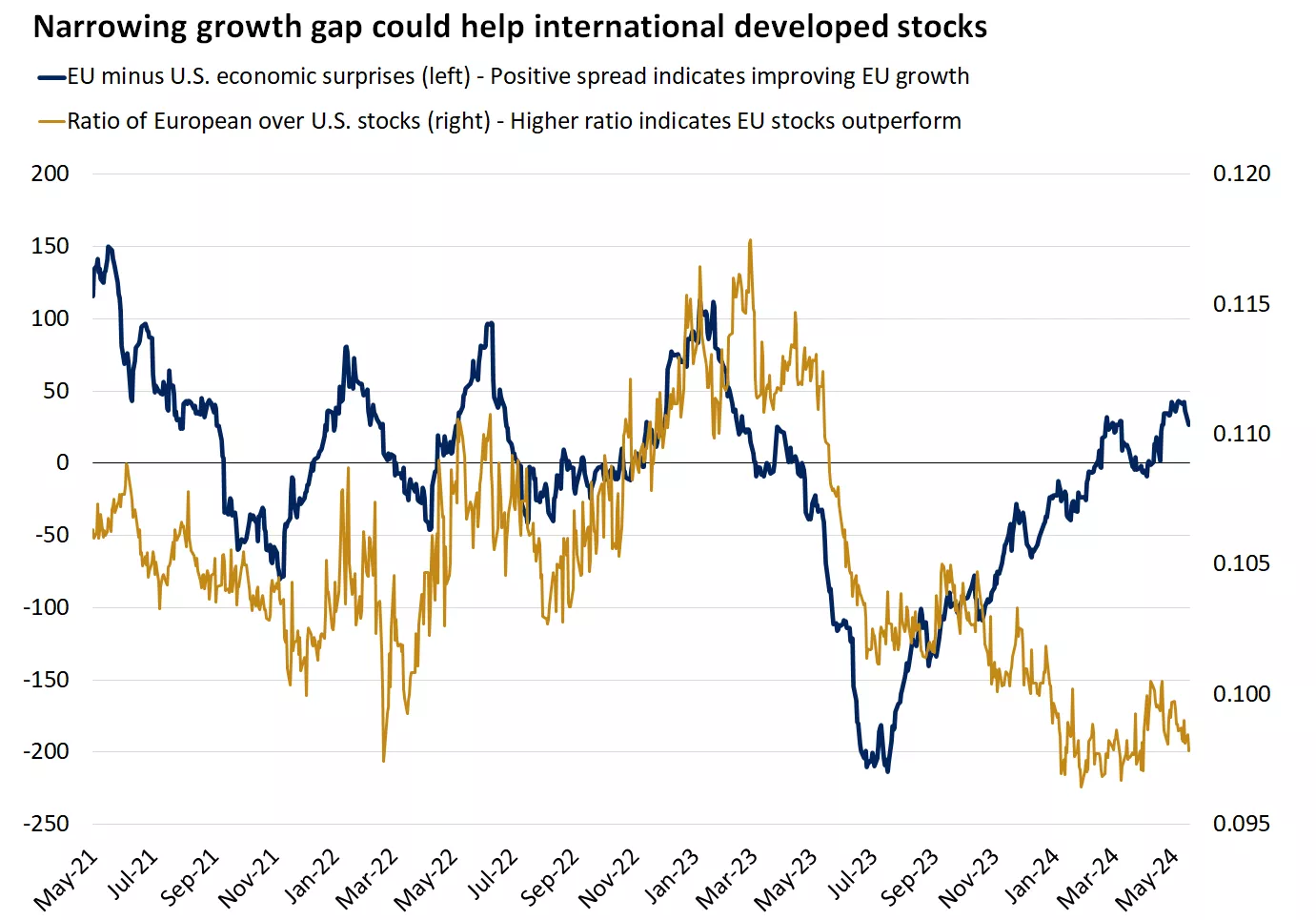

This chart shows the ratio of the STOXX 600 to the S&P 500 along with the difference between the Citi Economic Surprise Index in Europe and the U.S. Past performance does not guarantee future results.

This chart shows the ratio of the STOXX 600 to the S&P 500 along with the difference between the Citi Economic Surprise Index in Europe and the U.S. Past performance does not guarantee future results.

A modest eurozone recovery appears to be underway, as growth picked up more than expected in the first quarter, and timely survey indicators suggest the region’s outlook is improving. Despite unemployment falling to historic lows, inflation pressures have receded, and the ECB has started to ease policy. With eurozone activity rebounding from a lull and U.S. economic activity normalizing after a period of exceptional strength, we believe overseas developed-market stocks offer catch-up potential and diversification benefits.

In response to an uncertain economic environment and an ongoing real estate crisis, Chinese policymakers have lowered interest rates, allowed banks to keep smaller reserves, and announced measures to absorb some of the excess housing inventory. The policy support sparked a second-quarter rebound in stocks, but we remain cautious on the sustainability of the rally, as earnings estimates hover around 2017's earnings numbers.

More central banks began easing policy in the second quarter, with the ECB and BoC lowering interest rates in June. Central banks will likely take a cautious approach to rate cuts to ensure inflation is contained, but we think a multiyear easing cycle will continue to gain steam next year. Lower rates can help drive a recovery in manufacturing activity and benefit cyclical sectors.

Election issues and implications

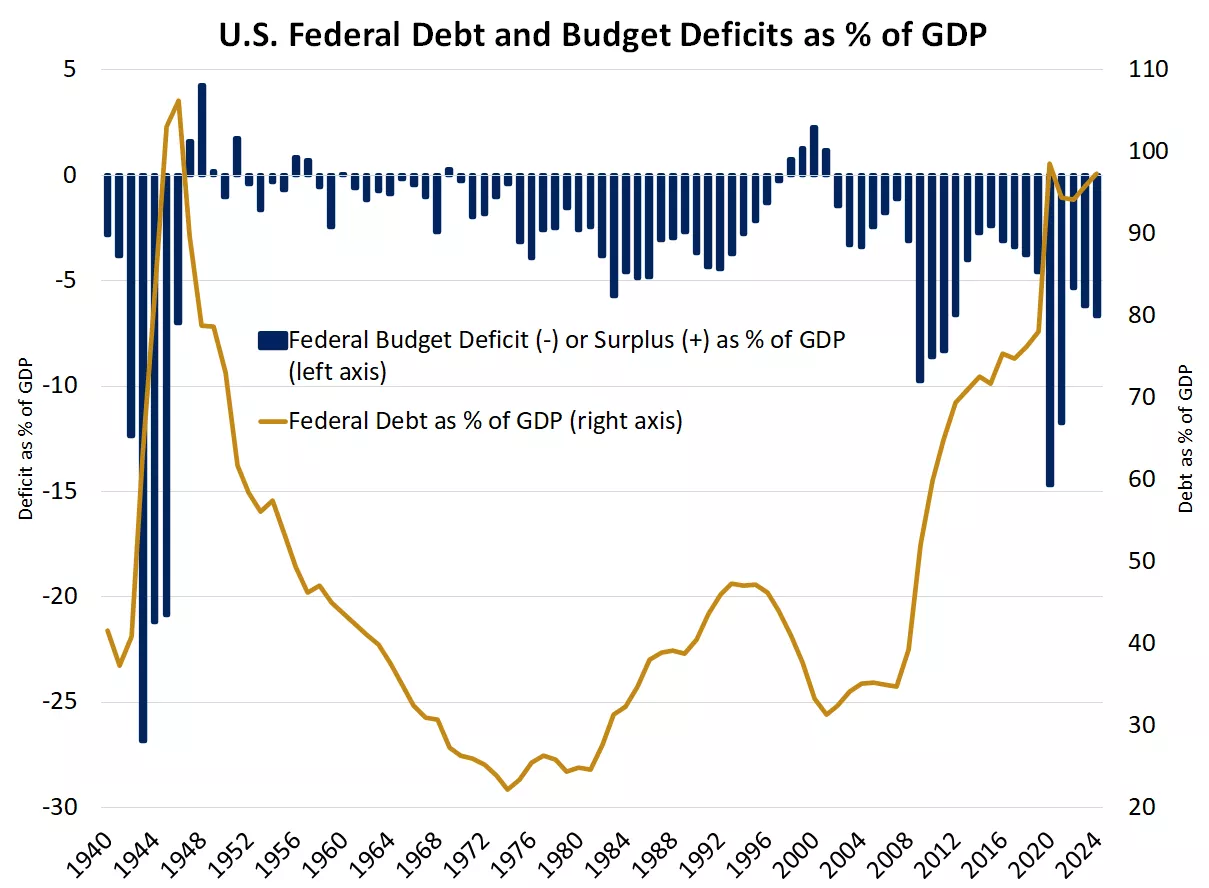

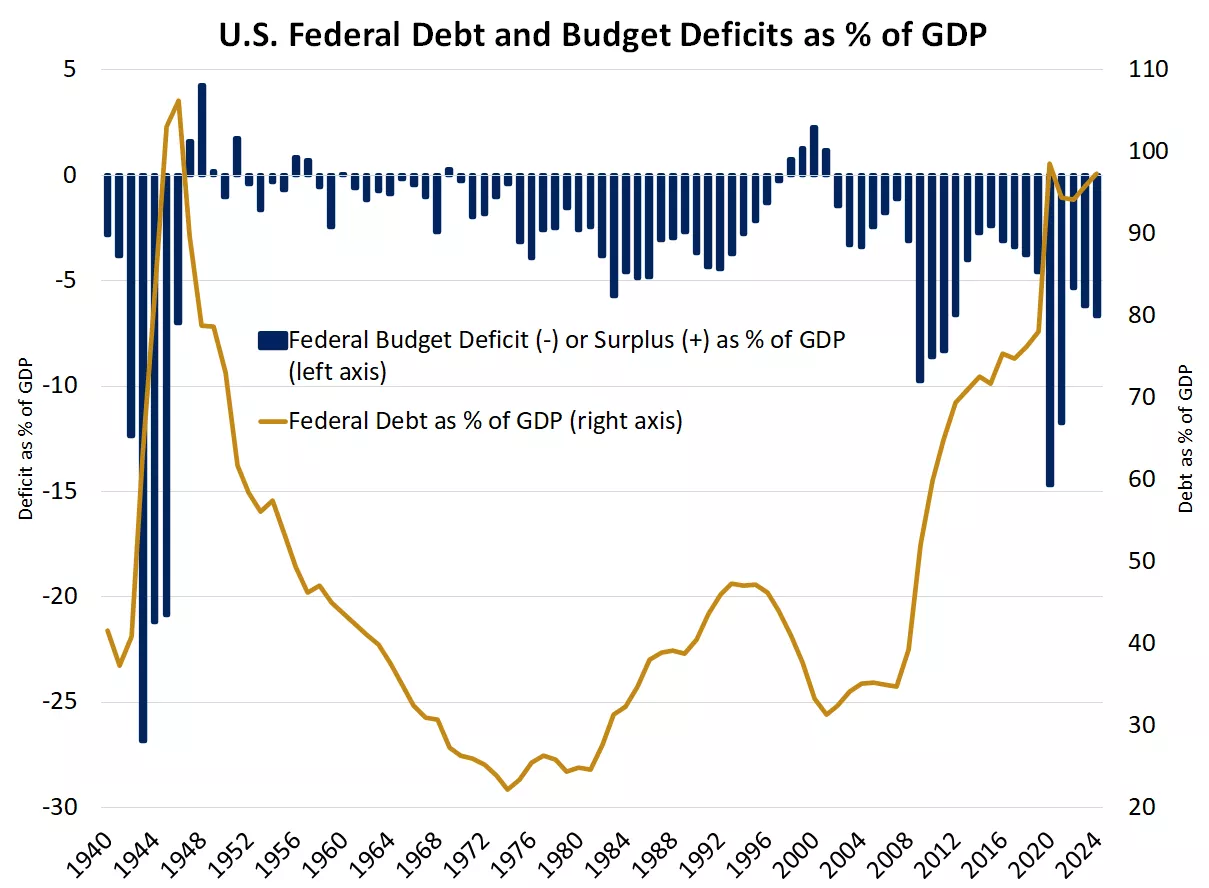

This chart shows federal debt as a percent of GDP and the federal budget deficit as a percent of GDP from 1940 – present.

This chart shows federal debt as a percent of GDP and the federal budget deficit as a percent of GDP from 1940 – present.

We believe several issues will be raised during the U.S. presidential campaign that connect to fundamental factors important to the economy and markets, including government debt, Fed policy and trade. The election’s outcome shouldn’t dramatically alter the course of the markets or economy, but these factors may have some implications.

U.S. budget deficits have run north of 6% of GDP in recent years. We’ve seen larger, rising U.S. deficits as a percentage of GDP (mid-1970s, early 1980s, early 1990s, 2008–2010), but these accompanied periods of economic weakness. Today’s sizable deficits are occurring with above-average GDP growth. We believe this could require more fiscal restraint ahead. While the U.S. government’s $35 trillion-and-growing debt is an astronomical number, as a percentage of GDP, it’s not yet at a level that limits the U.S. government’s ability to borrow at reasonable rates. Favourable economic policies can help delay or lessen those risks, but we think the solution will require fiscal spending and tax adjustments. But we don’t expect either candidate this year to pursue material policies to address long-term debt issues.

We expect the campaign trail to include tough talk on trade with China. The U.S. economy’s growth does not rely dramatically on trade, but the use of tariffs does present an inflationary risk. While such tactics were leveraged during former President Trump’s term, they occurred within a much more benign inflation environment. We think tariff policies will instigate some trade-war anxieties for the markets ahead, but we think domestic consumption and investment trends will be the more powerful influence on economic outcomes.

We expect the Fed to act solely under the direction of incoming inflation and economic data, but the timing of such moves will likely occur around the election. We also could see some election-driven uncertainty around the future of Fed Chair Jerome Powell’s role (whose term ends in 2026) if Trump were to propose a new Fed chief.

Brian Therien

Investment Strategy

Source: 1 Statistics Canada 2 FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| TSX | 22,674 | 2.8% | 8.2% |

| S&P 500 Index | 5,615 | 0.9% | 17.7% |

| MSCI EAFE * | 2,418.31 | 2.3% | 8.1% |

| Canada Investment Grade Bonds * | 0.7% | 0.2% | |

| 10-yr GoC Yield | 3.40% | -0.1% | 0.3% |

| Oil ($/bbl) | $82.27 | -1.1% | 14.8% |

| Canadian/USD Exchange | $0.73 | 0.1% | -3.2% |

Source: FactSet, 7/12/2024. Bonds represented by the Bloomberg Canada Aggregate Bond Index. Past performance does not guarantee future results. * Source: Morningstar Direct, 7/14/2024.

The Week Ahead

Important economic releases this week include CPI inflation for June and retail sales data.

Brian Therien

Senior Analyst, Investment Strategy

CFA®

Brian Therien

Senior Analyst, Investment Strategy

CFA®

Important information :

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.