Where does the market go from here?

There’s an old saying about roller coasters: They go up, they go down, you end up where you started, and it cost you to ride. The markets have been on a similar track over the past year, enduring a historic drop and a climb to get back to where they started before the pandemic.

But make no mistake, investing is a journey, not a circular trip. A well-built portfolio, disciplined approach and long-term perspective equipped investors to navigate and even benefit from – not pay the cost of – the ride. There’s plenty of track ahead, though.

Where does the market go from here?

The steep drop is followed by a long climb.

Last year’s recession reset the economic clock. We think we’re in the early stages of an extended expansion that will speed up in the second half of 2021 and then climb at a moderate pace in the coming years.

A key driver of this is the health of the labour market, since consumer spending comprises nearly 60% of Canadian GDP. We think this will be a temporary stall in the recovery, but we anticipate the economy to gain momentum in the second half of this year.

The unemployment rate near 9%is still punitively high – but well below the nearly 14% rate of a year ago. We believe the unemployment rate could be near or below 8% in Canada and in the mid- to upper 5% range in the U.S. by year-end. This is still well above the pre-pandemic levels but on an improving path.

The 2020 recession was the shortest but most severe on record. While downturns are painful, it’s the ensuing recoveries that make it worth staying in your seat. Over the last 50 years, the average market return in the calendar year after a recession was 8.1%1. Equities rose sharply in the second half of 2020, but we think a sustained expansion will set a favourable foundation for markets in the coming years.

Returning to level doesn’t mean the end of the line.

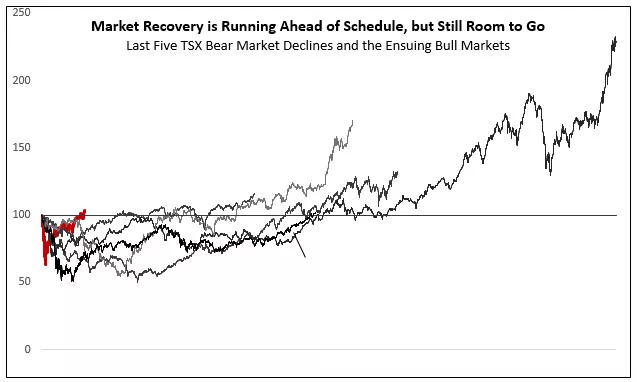

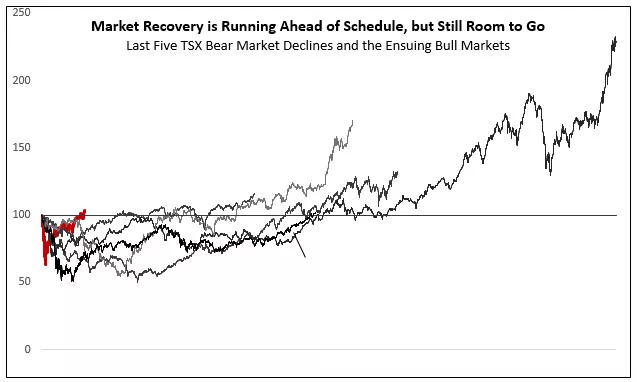

The stock market fell 34% in just over 20 trading days last year1. The initial recovery was also swift, with stocks having recouped their losses on the way to new record highs this year. This marked the fastest 30%-plus market drop and recovery on record.

The good news is, this recovery doesn’t mark an exhaustion point for stocks. Looking at bear markets since World War II, once the market returned to the previous high, it gained an average of 14.3% over the following 12 months1.

2020 was the fifth instance since 1950 in which the S&P 500 declined by more than 30% within a calendar year. In these past instances, the market gained an average of 27.2% in the following calendar year1.

These examples support a positive outlook but aren’t a predictor of future gains. In fact, while the fundamental economic and policy backdrop is favourable, we believe market returns will be more moderate this year. The recent sharp rally has already priced in a portion of the economic recovery ahead, a reminder of the market’s forward-looking nature.

Prepare for a bumpier ride ahead.

While we think 2021 will be a positive year for the markets, we expect the path ahead to be bumpier than the one we’ve traveled since last April. We anticipate spurts of disappointment amid the recovery process and periodic policy anxieties to produce more frequent market swings.

Some investors believe pullbacks signal a recovery’s demise. But bouts of volatility in the first two years of bull markets are quite normal. The TSX increased 60% and the S&P 500 rose 70% in the 10 months following last March’s lows, similar to the beginning of the previous bull market that started in 2009, which saw stocks rise 69% in the first 10 months.

Source: S&P/TSX Index, Past performance is not a gurantee of future results, the TSX is an unmanaged index and cannot be invested in directly. For periods prior to 1987, the MSCI Canada Index was used.

It can be easy to focus on one portion of the track, but we believe investors should take a broader perspective. Despite the sizable ups and downs along the way, the domestic stock market gained a healthy average of 11% over the past two calendar years. The S&P 500 did even better, gaining 31% in 2019 and 18% in 2020. This is the 16th time since 1950 in which the S&P 500 has gained more than 15% in back-to-back years. The average return in the year following was 9.2%1.

This highlights the importance of:

- Staying invested amid the twists and turns

- Appropriately calibrating your expectations for positive but more moderate returns ahead

- Ensuring your investment decisions remain aligned to your goals

Your Edward Jones advisor is along with you for the ride, identifying strategies and opportunities to help you remain on track toward your long-term financial goals.

Craig Fehr, CFA

Investment Strategist

Sources: 1. Bloomberg, S&P 500 index return.