Understanding risk

While few people enjoy taking risk, it's a normal part of investing. In fact, some risk is actually beneficial and serves a valuable purpose. If investors didn't accept some risk, they wouldn't have the potential to achieve higher returns. However, it's important to ensure you're not taking on unnecessary risk. The goal is to determine what level of risk you're comfortable accepting and then balance it with the required risk necessary to achieve your long-term goals.

Risk in the investment world is usually associated with market volatility. A commonly used phrase is, "Risk and return go hand in hand," meaning the higher the return potential, the more volatility you must be willing to accept. Markets never move in a straight line — they experience ups and downs. Although the stock market has averaged over a 9.5% annual return since 1977, it has returned 5% to 15% only 15 times, and only 11 times has it returned between 8% and 12% in a single year. The market has had more than twice as many up years (31) as down years (12), serving as a reward to long-term investors who can handle shorter-term volatility.

1/1/1977 - 12/31/2019

| Total Returns | # of Years | % of Time |

|---|---|---|

| Greater than 30% | 6 | 14% |

| Between 15% and 30% | 10 | 23% |

| Between 5% and 15% | 15 | 35% |

| Between -5% and 5% | 4 | 9% |

| Between -15% and -5% | 7 | 16% |

| Between -30% and -15% | 0 | 0% |

| Worse than -30% | 1 | 2% |

Source: Morningstar Direct. Total returns including dividends. Post performance does not guarantee future results.

Overall, individuals face many types of investment risk, such as interest rate risk, credit risk, economic risk and currency risk. Investors, meanwhile, often define risk as the potential for loss.

At its most basic level, risk refers to uncertainty and is much broader than volatility and the potential for (and size of) losses. Perhaps the biggest risk you may face is not reaching your financial goals. For example, a portfolio that is all in cash may have little, if any, volatility, but it also won't provide any growth potential or inflation protection. For retirees, not keeping up with inflation, or not having the right withdrawal strategy, can lead to another major risk: the risk of outliving their money. Ultimately, the key is to determine what level of risk is appropriate to help you achieve your financial goals.

The next step is really a balancing act, as there sometimes can be a discrepancy between how much risk you are comfortable taking and how much you actually have to take to achieve your goals. This is where you may need to make some important decisions. Your financial advisor can help you build a portfolio that balances your risk tolerance, capacity for risk, and the risk you’re required to take with your financial goals.

For example, suppose you want to retire at age 55, and you have a low risk tolerance. However, your financial advisor estimates that to accomplish this goal, you will need a higher return, resulting in a higher degree of portfolio volatility. In this case, you may have several choices, including working longer, saving more or accepting a higher degree of volatility. While this is a personal decision, by better understanding your goals, and the risks associated with achieving them, you can make a more informed decision.

While risk may come in many forms, the process of determining what level of risk is appropriate covers three main areas:

Risk tolerance - This refers to your willingness or comfort level with taking risk. Typically, you'll be asked to complete a questionnaire that's used to gauge how you might react to risk in different situations. Gauging risk tolerance and your potential behaviour is important because it's unlikely you'll reach your long-term goals if you abandon your strategy during inevitable short-term market declines.

Risk capacity - While risk tolerance refers to your comfort with risk, risk capacity considers your ability to handle risk. Your investment time horizon is often one of the biggest factors in determining your risk capacity. For example, if you're younger and preparing for retirement, you have more time to make up for potential declines and could reasonably handle more volatility. However, if you're retired, your ability to handle stock market declines is likely smaller. Other items, such as income needs, may influence your risk capacity. For example, retirees relying on their portfolios for a large portion of their income may not be able to handle as much volatility as those who have more discretionary income and are not reliant on their portfolios for their retirement needs.

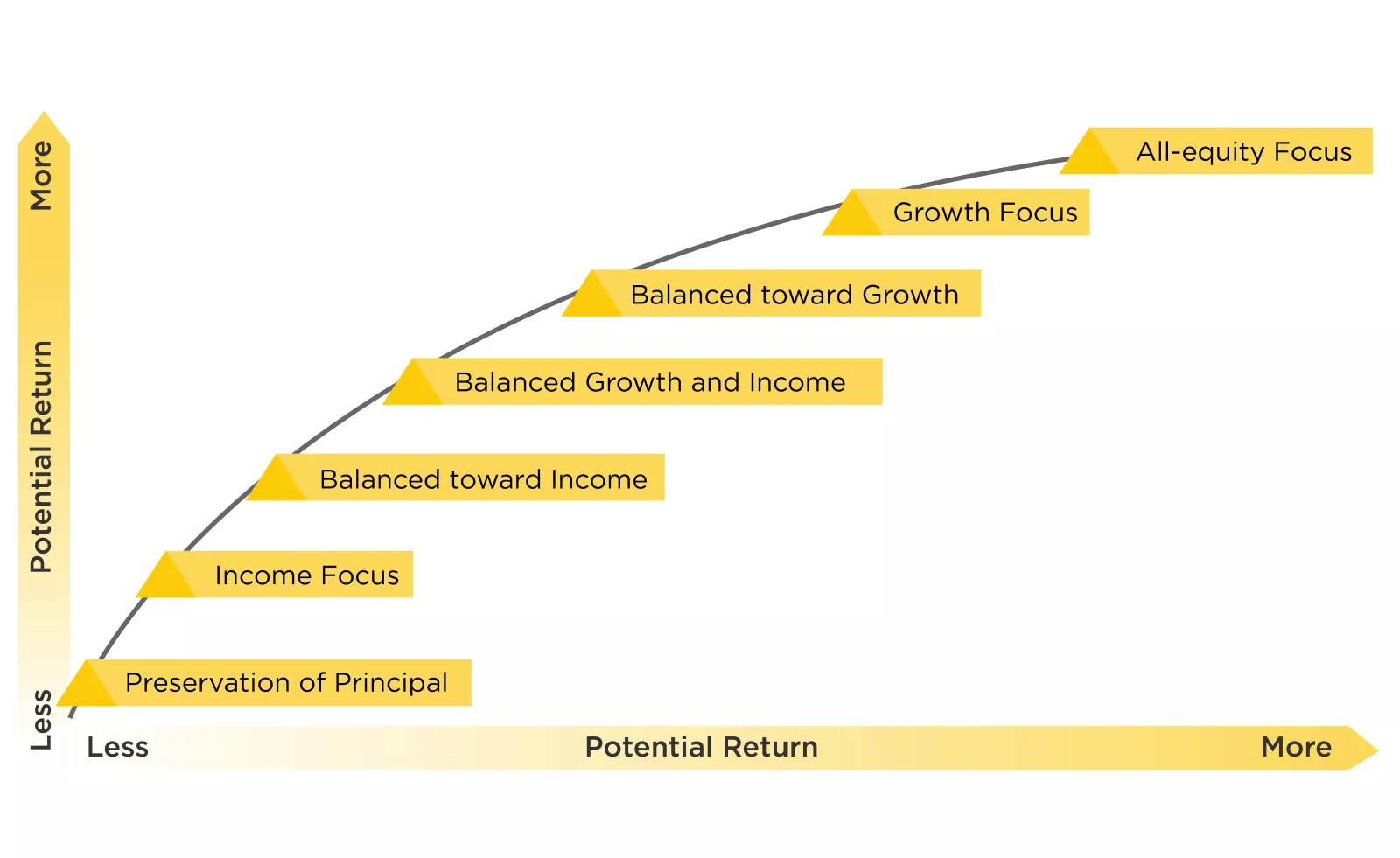

Required risk - This refers to the level of risk required to achieve your investment goals. In the chart below, the higher the return needed to reach your goals, the more potential risk you'll need to take to achieve them. As you discuss your goals with your Edward Jones financial advisor, you can determine which Portfolio Objective aligns with the required return you need.

This chart shows the greater the potential risk, the greater the potential return and vice versa. It uses a line that starts where the lowest risk and return meet and rises up to where the greatest risk and return meet. Portfolio Objectives are indicated along the way that align with the combination of risk and return. Income Focus is the Portfolio Objective that represents the lowest combination of risk and return; the second lowest combination is Balanced toward Income; the next lowest is Balanced Growth and Income; the next up is Balanced toward Growth; nearing the top where the highest risk and return meet is Growth Focus; and the last Portfolio Objective offering the greatest combination of risk and return is All Equity Focus.

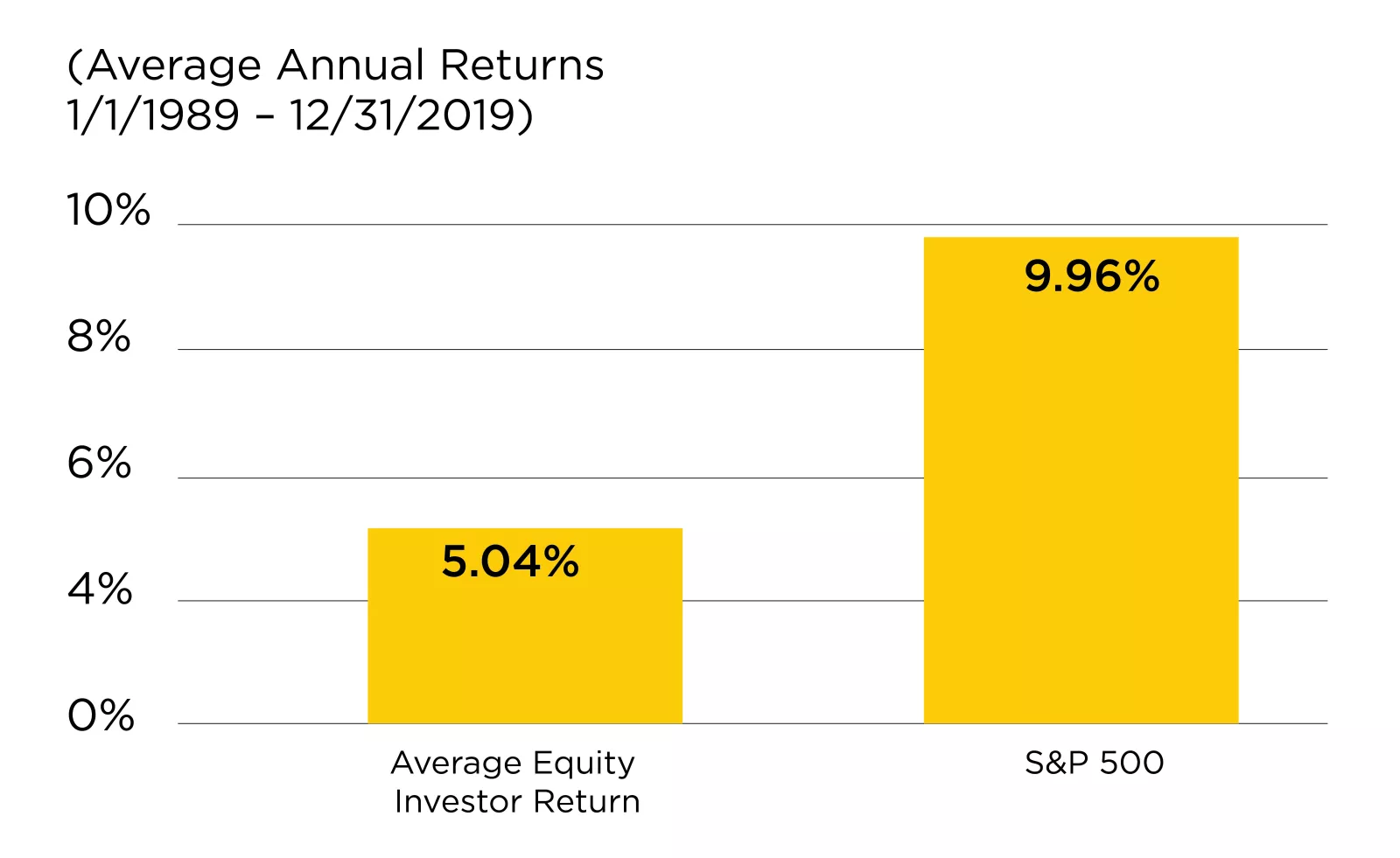

Typically, what prevents most investors from reaching their goals is not market volatility itself, but their reaction to this volatility. Investing based on emotions can often lead to one lasting emotion: disappointment. For example, the average investor's equity investments performed much worse than the S&P 500, as shown below according to a study done in the US. It's not because people owned the "wrong investments," but because they chased performance, buying when stocks were up and then selling when they dropped in value.

Source: DALBAR, QAIB 2020. Annualized return for the past 30 years ending 12/31/2019. The Equity benchmark is represented by the S&P 500. Returns do not subtract commissions or fees. This study was conducted by an independent third party, DALBAR, Inc. A research firm specializing in financial services, DALBAR is not associated with Edward Jones. Past performance does not guarantee future results.

This is a bar graph that shows the average equity investor realized a 5.04% average annual return for the past 30 years (from 1/1/1989 to 12/31/2019) compared to the S&P Index, which achieved a 9.96% average annual return during the period.

Understanding your comfort level with risk can only make you a better investor and perhaps avoid some of these pitfalls. By knowing your risk tolerance in advance, you can better control your emotions and stick to your long-term strategy during the inevitable market corrections along the way.

It's important to discuss your goals and the amount of risk you're willing to take to reach them with your Edward Jones financial advisor. You may need to make some difficult decisions. But, ultimately, these decisions may help you avoid the biggest risk of all: not reaching your financial goals.

Past performance does not guarantee future results. The TSX is an unmanaged index and cannot be invested into directly. Diversification does not guarantee a profit or protect against loss.