Are your health and wealth plans in sync?

Among the many things we’ve learned in the past year is the importance of our health. As the saying goes, you cannot enjoy wealth if you’re not in good health. Yet we spend a significant amount of time preparing financially for our retirement without serious considerations of our healthcare.

The fact is retirement planning and healthcare are closely connected and the choices you make today will have an impact in your retirement years.

Planning for the unexpected: What should I consider?

More than 97 per cent of retirees and 99 per cent of those age 75 and over report that health is more important than personal wealth.* Yet despite this near- universal appreciation for the importance of physical and mental well-being, many of us will face health care crises or challenges as we’re planning for, or living in, retirement.

Your Edward Jones financial advisor can work with you to help ensure your financial strategies reflect your goals and that they take into consideration the possibility of unexpected, additional, or prolonged healthcare expenses. These strategies may include investment and insurance solutions that ensure a healthcare event doesn’t take you off track.

Thinking through the following considerations can help ensure your wishes are understood and followed – as well as helping to prevent surprises and more difficult conversations in the future.

Planning for the unexpected: Who is authorized to make decisions?

Planning for your well-being includes having documents in place to address what happens in the event you are not able to make financial decisions for yourself. You may be temporarily incapacitated or chronically debilitated, but in either case, having documents in place that grant someone else the authority to make financial decisions on your behalf is a key aspect of ensuring your healthcare and financial planning are in order.

Many people don’t realize that, generally speaking, no one has the automatic authority to act on your behalf — not a spouse, not a child, no one. We only have to think about a couple of examples to appreciate the implications of this. Recall a time when there was a mistake on your phone bill or an issue with your utility provider. You would have been asked a whole lot of questions to verify your identity and you wouldn’t have been able to do anything about the issue unless and until the company was satisfied that you were who you said you were.

Not being able to immediately deal with an erroneous phone bill or an uncooperative utility provider may be inconvenient, but the impacts can be much more severe when you are facing a healthcare crisis and you haven’t granted anyone the legal authority to act on your behalf. Investment accounts or funds required to pay for your care could be inaccessible during a time when the stakes are high and time is of the essence. To ensure the best possible outcomes for you and your family, you’ll want to make sure it’s as easy as possible for your trusted representative to be able to prove they have the authority to address your financial affairs.

Powers of attorney: Are they up to date?

You may have signed a Power of Attorney (POA) document for specific accounts, but did you subsequently sign a more general document that may have revoked that document? Did you get divorced or married since you signed it? Do you remember who it named? Did you name an alternate in case the first named person cannot act? Has the person you named moved to the US, or are they a US citizen or dual citizen?

A POA contained on a financial institution’s forms generally deals only with specific assets held at the particular institution and does not grant broad authority to deal with your financial assets held elsewhere. Reviewing these documents and coordinating them with an Enduring Power of Attorney for Property (also known as a Continuing Power of Attorney or Mandate depending on your province) will ensure that the individual you want to have the authority to manage your Edward Jones accounts, as well as all of your other financial affairs, has the legally-recognized right to do so.

An Enduring POA is a document that gives one or more individuals the authority to make broad financial decisions for you in the event you become unable to do so because of physical or mental impairment. If you don’t specify any limitations, they will be able to do your banking, sign contracts, make investment decisions, sell real estate -- essentially any and all financial decisions (other than make a Will or designate beneficiaries). He or she must manage your affairs for your benefit and can be required to provide an accounting of their decisions.

Keep in mind that if you don’t have this documentation in place, there are provincial “default rules” that apply that will dictate who has the right to be first in line to act on your behalf. This may not be the person you want acting for you, so make sure you take the necessary steps to name the person of your choosing.

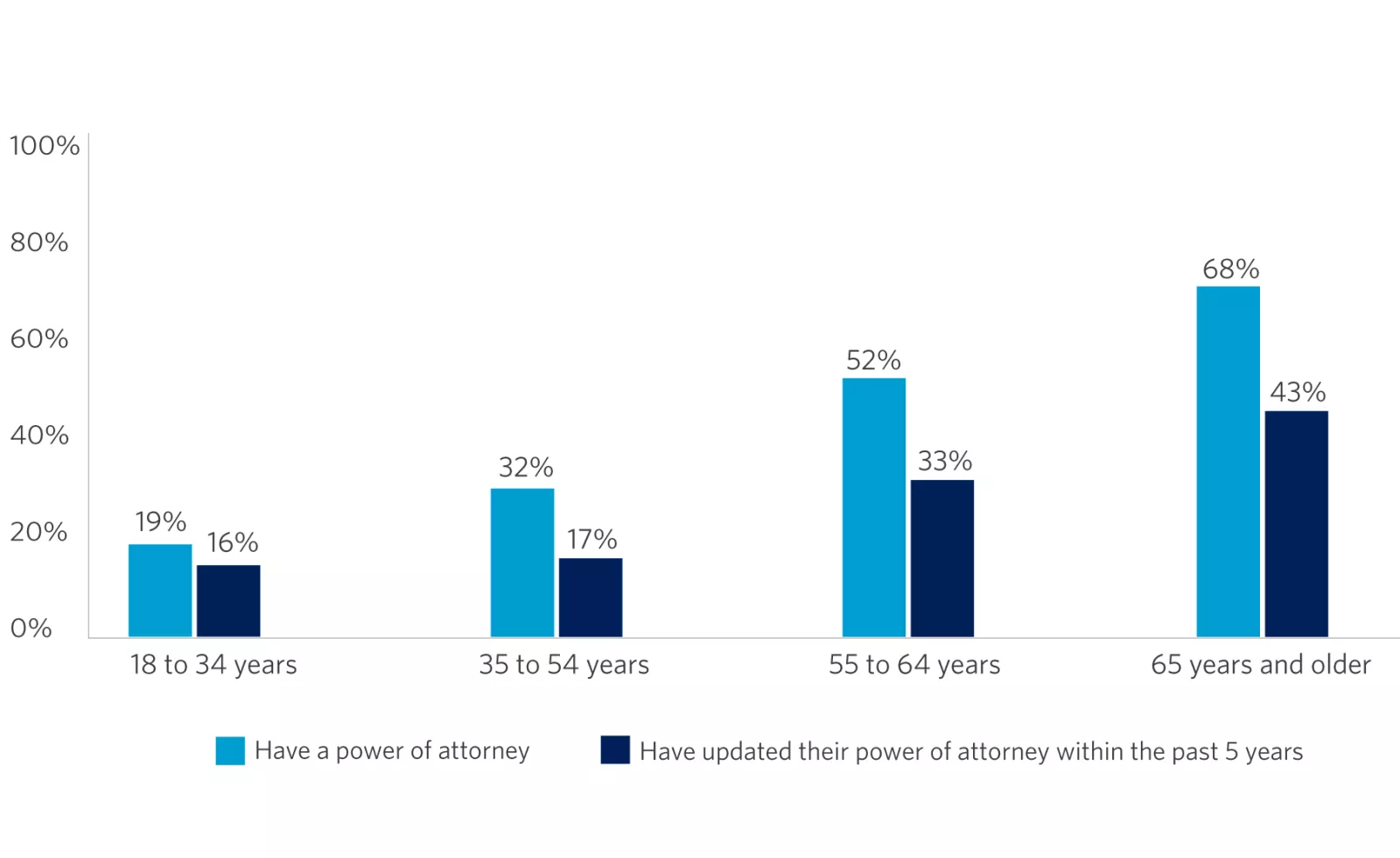

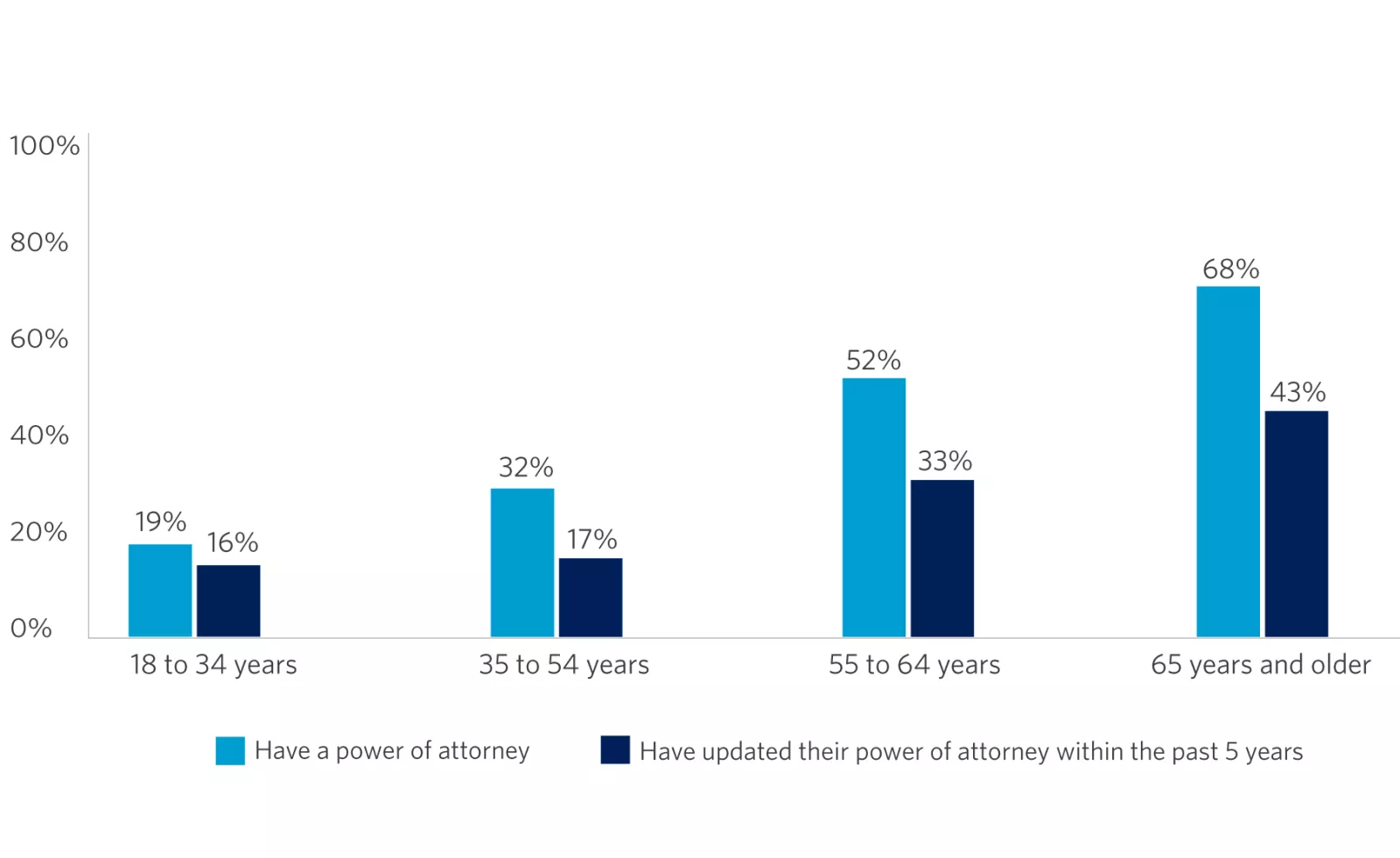

Percentage of Canadians that have a POA and have updated it within the past 5 years

Source: 2019 Canadian Financial Capability Survey, Financial Consumer Agency of Canada

This chart shows that for all age groups of Canadians, less than 70% have a POA and less than half have updated their POA in the last five years.

POAs on foreign property: Are you aware of the rules?

Another key consideration is that each jurisdiction has its own rules about POAs and they don’t necessarily recognize the validity of documents prepared outside that jurisdiction. Imagine your spouse, children, parents or trusted friend trying to deal with your property in another country (such as an overseas bank account or your vacation home in the US) without the appropriate documentation. Would they be able to access the account? Put in place insurance or negotiate rental contracts?

Would they be able to hire a real estate agent or sell the property? Perhaps eventually, but we want to ensure things go as smoothly as possible during times of stress so your loved ones can focus on what’s most important.

It’s a good idea to consider having local powers of attorney for property in each jurisdiction where you own assets or spend significant time. But remember to consult with your local lawyer to coordinate this planning – people have inadvertently revoked their Enduring POAs because the language of the new document was too broad and didn’t contemplate the existing POA.

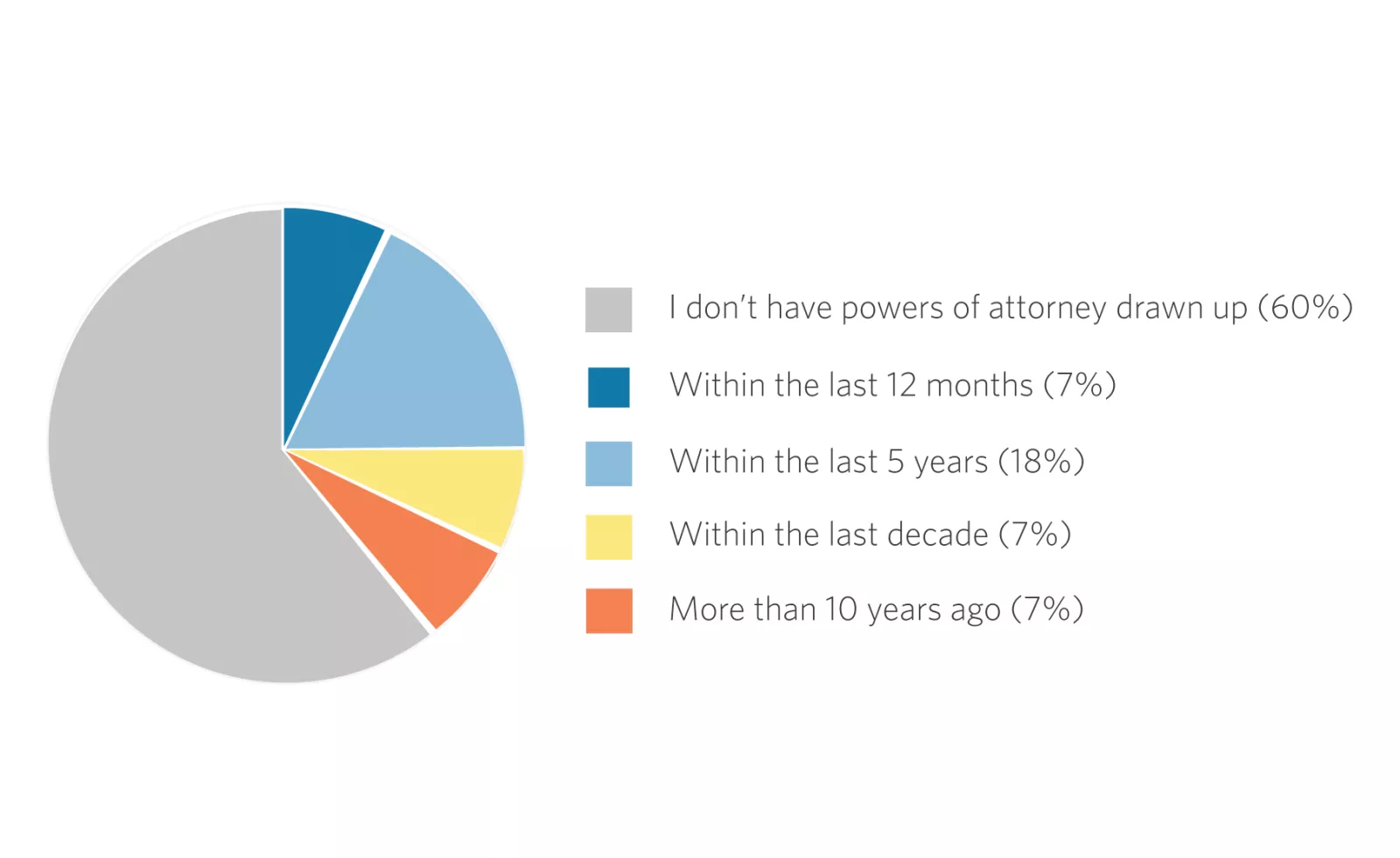

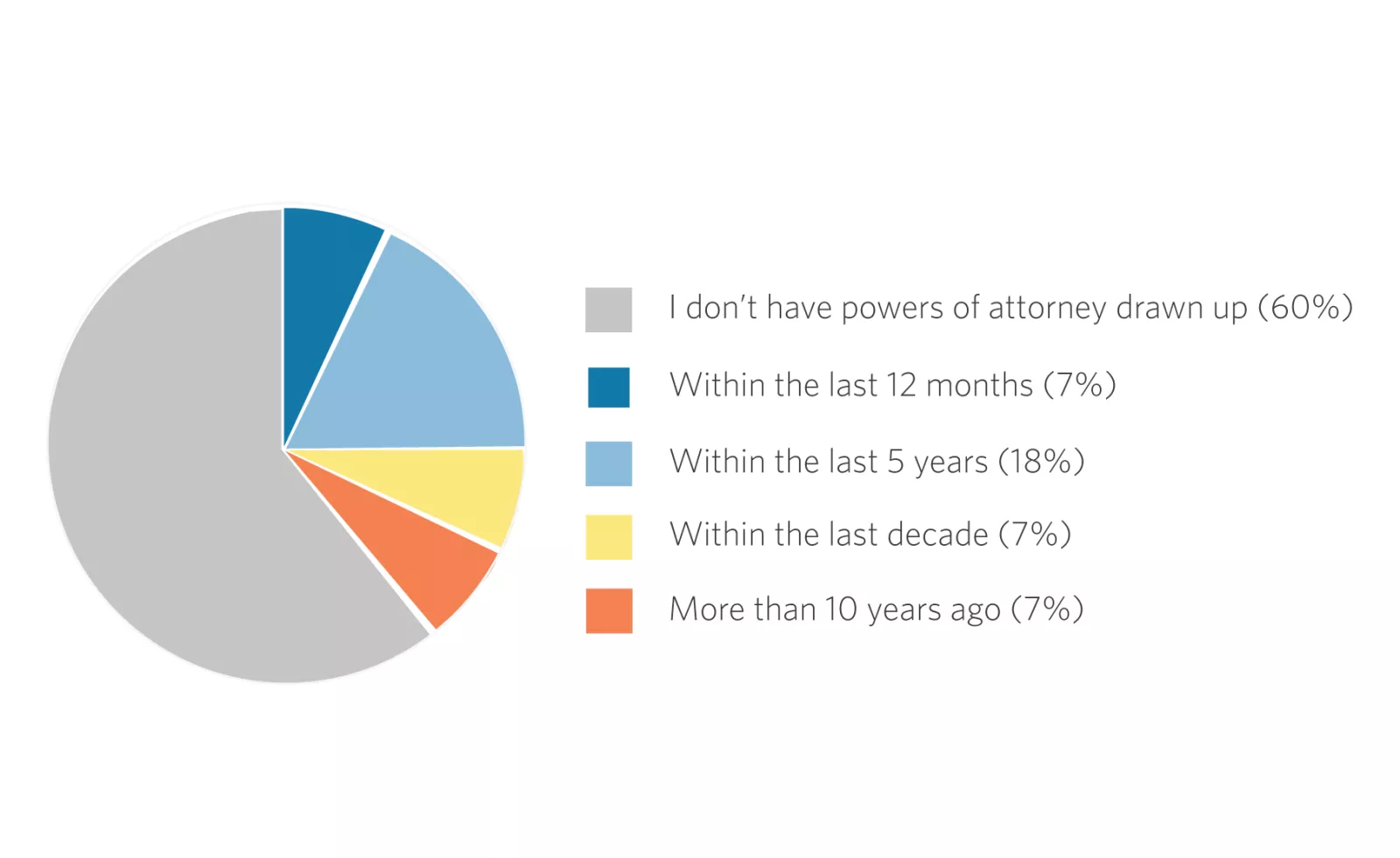

Percentage of Canadians that have a POA and when it was last updated

Source: 2019 Canadian Financial Capability Survey, Financial Consumer Agency of Canada

This chart shows that sixty percent of Canadians do not have a POA, only seven percent of all Canadians have updated their POA in the last year, eighteen percent in the last five years and fourteen percent within the last decade or more.

Additional protections are available

In addition to a POA document, there’s another document that can significantly increase the value of a POA and help ensure your goals and values are known and protected. This is achieved by instituting a “trusted contact” at Edward Jones.

A trusted contact is someone that your financial advisor can reach out to if they are unable to get in contact with you or if there are concerns about your capacity to fully comprehend financial issues or make informed decisions.

How can a trusted contact help?

By completing the Trusted Contact Form, you authorize Edward Jones to contact your designated person in the event that concerns arise regarding the inability to make contact with you; or if concerns arise about your capacity to fully comprehend financial issues and/ or make informed decisions concerning your Edward Jones accounts.

This authorization allows Edward Jones to provide information to the person you designate about activity we observe or transactions you request which would allow the designated person to determine what steps need to be taken to review the situation and identify actions that should be taken to protect you or your property.

Already have a POA?

- Confirm with your attorney (the person you’ve named in your POA) that they are willing and able to take on this important role if the need arises

- Make sure you and our attorney know where your POA and other important financial documents are located

- Regularly review the terms of your POA to make sure it still reflects your wishes

- If you make any changes to your Enduring POA or financial institution POA forms, you should advise your financial advisor and lawyer immediately

- Review your financial records on a regular basis and talk to your attorney about your preferred approach to handling money and property

A Trusted Contact Form is not a power of attorney or trading authority and does not authorize Edward Jones to accept any transaction related instructions. But it does provide an additional layer of protection in the event you are experiencing a healthcare (or other) crises.

Your Edward Jones advisor, in partnership with your other advisors, can help you create or update your comprehensive plan for the unexpected.

Important information:

* Source: The Four Pillars of the New Retirement, Edward Jones & Age Wave.

Edward Jones, its employees and financial advisors cannot provide tax or legal advice. You should consult your lawyer or qualified tax professional regarding your situation.